In today’s fast-paced business environment, large organizations face the challenge of managing complex accounts payable processes efficiently and effectively. Accounts payable software plays a crucial role in streamlining these processes, offering a range of benefits that can significantly enhance financial operations.

This guide delves into the key features, benefits, and considerations for choosing accounts payable software specifically tailored to the needs of large businesses. We’ll also explore best practices for implementation, case studies of successful deployments, and emerging trends shaping the future of accounts payable automation.

Key Features of Accounts Payable Software for Large Businesses

Accounts payable software is essential for large businesses to streamline their financial operations and improve efficiency. These software solutions offer a range of features that are specifically designed to meet the unique requirements of large organizations.

Key features of accounts payable software for large businesses include:

Invoice Processing Automation

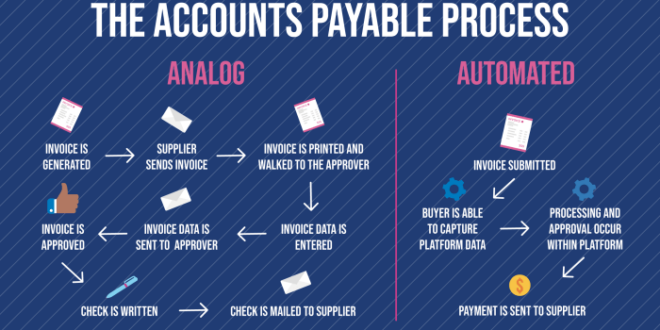

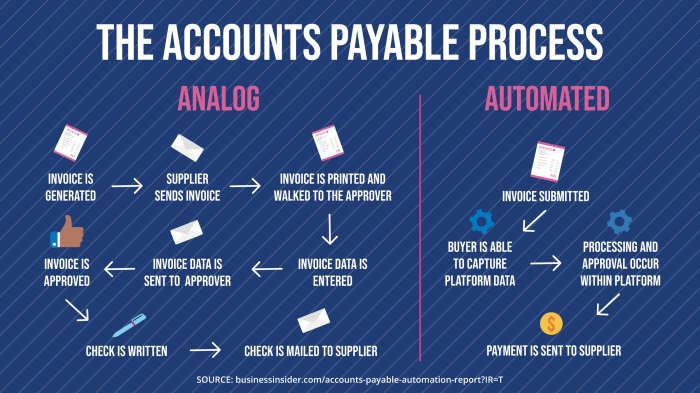

Large businesses typically receive a high volume of invoices from multiple vendors. Accounts payable software can automate the invoice processing process, reducing the risk of errors and improving efficiency. Features such as optical character recognition (OCR) and electronic invoice (e-invoice) integration can capture and process invoices quickly and accurately.

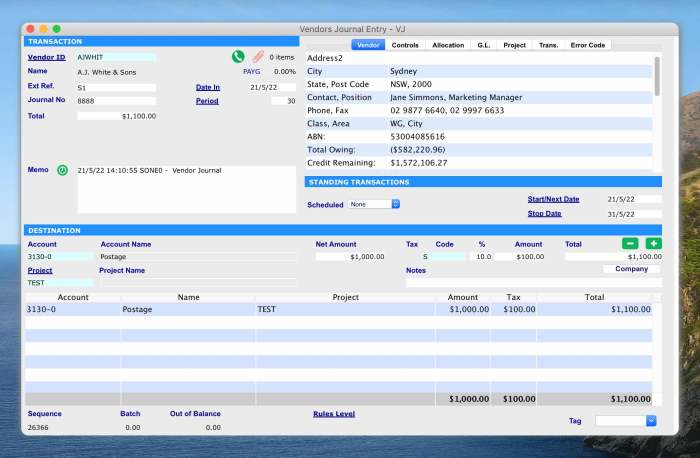

Vendor Management

Accounts payable software can help large businesses manage their vendor relationships effectively. The software can store vendor information, track purchase orders, and monitor vendor performance. This information can be used to identify potential savings opportunities and improve supplier relationships.

Payment Processing

Accounts payable software can streamline the payment process for large businesses. The software can generate payments, schedule payments, and track payment status. Features such as electronic payment (EFT) and ACH integration can reduce the risk of late payments and improve cash flow management.

Scalability and Customization

Large businesses need accounts payable software that is scalable and customizable. The software should be able to handle a high volume of transactions and be able to adapt to the changing needs of the business. Customization options allow businesses to tailor the software to their specific requirements.

Benefits of Implementing Accounts Payable Software

Implementing accounts payable software can significantly benefit large businesses by automating their accounts payable processes. These benefits include cost savings, efficiency improvements, reduced errors, enhanced compliance, and improved financial reporting.

Cost Savings

- Automating accounts payable processes can reduce labour costs by eliminating manual tasks, such as data entry, invoice processing, and payment processing.

- Software can help businesses negotiate better payment terms with vendors, leading to discounts and early payment incentives.

- Improved efficiency can reduce the time spent on accounts payable tasks, freeing up staff for other value-added activities.

Efficiency Improvements

- Automating accounts payable processes can significantly reduce the time it takes to process invoices, approve payments, and reconcile accounts.

- Software can streamline the approval process by routing invoices to the appropriate approvers electronically.

- Electronic invoice processing can eliminate the need for manual data entry, reducing errors and saving time.

Reduced Errors

- Automated accounts payable software can reduce errors by eliminating manual data entry and automating calculations.

- Software can help businesses track and manage invoices more effectively, reducing the risk of duplicate payments or missed payments.

- Automated approval processes can help ensure that invoices are approved by the correct individuals, reducing the risk of unauthorized payments.

Enhanced Compliance

- Accounts payable software can help businesses comply with regulatory requirements by automating compliance-related tasks, such as tax calculations and reporting.

- Software can help businesses track and manage vendor relationships, ensuring that vendors are properly vetted and meet compliance requirements.

- Automated approval processes can help ensure that payments are made in accordance with company policies and procedures.

Improved Financial Reporting

- Accounts payable software can provide businesses with real-time visibility into their accounts payable data, improving financial reporting accuracy.

- Software can help businesses track and manage their cash flow more effectively, improving financial planning and decision-making.

- Automated accounts payable processes can reduce the risk of errors in financial reporting, improving the reliability of financial statements.

Considerations for Choosing Accounts Payable Software

When selecting accounts payable software for large businesses, several key factors must be considered to ensure optimal performance and alignment with business needs. These include:

- Vendor Evaluation: Assess the reputation, financial stability, and industry experience of potential vendors. Verify references and case studies to gauge customer satisfaction and software effectiveness.

- Software Capabilities: Determine if the software meets the specific requirements of the business, including invoice processing, vendor management, and reporting capabilities. Consider scalability, automation features, and integration options.

- Compatibility with Existing Systems: Ensure the software can seamlessly integrate with existing enterprise resource planning (ERP) systems, accounting software, and other relevant applications. Data exchange and interoperability are crucial for efficient workflow.

- User-friendliness: The software should be intuitive and easy to use for both accounts payable staff and other stakeholders. A user-friendly interface reduces training time and improves productivity.

- Support and Maintenance: Evaluate the vendor’s support capabilities, including response times, documentation quality, and training resources. Regular updates and maintenance are essential for ongoing software functionality and security.

- Integration Capabilities: Consider the software’s ability to integrate with other business systems, such as procurement, inventory management, and e-commerce platforms. Seamless integration streamlines processes and improves data accuracy.

Best Practices for Implementing Accounts Payable Software

Effective implementation of accounts payable software in large businesses requires a structured approach. Planning, communication, and training are crucial for success.

Planning

- Establish clear project goals and objectives.

- Define the scope of the implementation, including which processes will be automated.

- Identify the resources needed, such as personnel, budget, and timeline.

Communication

- Communicate the project plan and timelines to all stakeholders.

- Provide regular updates on progress and address any concerns.

- Establish a feedback mechanism to gather input from users.

Training

- Provide comprehensive training to users on the new software.

- Include hands-on exercises and real-life scenarios.

- Ensure users are comfortable with the software before go-live.

Data Migration

- Plan a comprehensive data migration strategy.

- Verify the accuracy and completeness of the data.

- Consider using data migration tools to automate the process.

Process Optimization

- Review existing accounts payable processes and identify areas for improvement.

- Configure the software to optimize workflows and eliminate bottlenecks.

- Continuously monitor and refine processes to ensure efficiency.

Ongoing Maintenance

- Establish a plan for software updates and maintenance.

- Provide ongoing training and support to users.

- Monitor the software’s performance and address any issues promptly.

Case Studies and Examples

Successful accounts payable software implementations in large businesses provide valuable insights into the challenges faced, solutions implemented, and results achieved. These case studies and examples showcase the transformative impact of technology in streamlining AP processes and driving operational efficiency.

The following table presents a comparative analysis of notable case studies, highlighting key aspects of their AP software implementations:

| Case Study | Company | Challenges | Solutions | Results |

|---|---|---|---|---|

| Case Study 1 | Global Manufacturing Corporation |

|

|

|

| Case Study 2 | Retail Giant |

|

|

|

| Case Study 3 | Healthcare Provider |

|

|

|

Emerging Trends in Accounts Payable Software

The accounts payable (AP) landscape is constantly evolving, driven by technological advancements that are transforming how businesses manage their financial operations. Emerging trends in AP software are shaping the future of AP processes, offering greater efficiency, accuracy, and control.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing AP by automating repetitive tasks, improving data accuracy, and providing real-time insights. AI-powered software can extract data from invoices, verify purchase orders, and flag potential errors. ML algorithms learn from historical data to identify patterns and anomalies, enabling predictive analytics and proactive risk management.

Robotic Process Automation (RPA)

RPA involves the use of software robots to automate rule-based, repetitive tasks such as invoice processing, payment approvals, and vendor onboarding. RPA bots can mimic human actions, freeing up AP teams to focus on higher-value activities and strategic decision-making.

Cloud-Based Solutions

Cloud-based AP software offers flexibility, scalability, and reduced IT infrastructure costs. Businesses can access their AP data and processes from anywhere with an internet connection, enabling remote work and collaboration. Cloud solutions also provide automatic updates and enhanced security measures.

Data Analytics and Reporting

Advanced AP software provides robust data analytics and reporting capabilities. Businesses can gain insights into their AP performance, identify areas for improvement, and make informed decisions based on real-time data. Customizable dashboards and reports allow for easy visualization and analysis of key metrics.

Integration with Other Systems

Modern AP software seamlessly integrates with other enterprise systems, such as ERP, CRM, and procurement solutions. This integration eliminates manual data entry, reduces errors, and provides a holistic view of the financial operations.

Mobile Accessibility

Mobile-friendly AP software empowers teams to manage their AP tasks on the go. Employees can approve invoices, check vendor payments, and access real-time data from their smartphones or tablets. This enhances productivity and facilitates remote work.

Last Recap

Implementing accounts payable software can transform the financial operations of large businesses, leading to significant cost savings, improved efficiency, enhanced compliance, and better decision-making. By carefully considering the factors discussed in this guide, organizations can select the right software solution and leverage its full potential to streamline their accounts payable processes and gain a competitive edge.